Gusto Employee Tax Calculator

For personal tax advice consult a CPA or licensed tax advisor. The main principle is that workers pay taxes in the state where they live and work.

3 Months Free On Any Gusto Plan Hatch Card

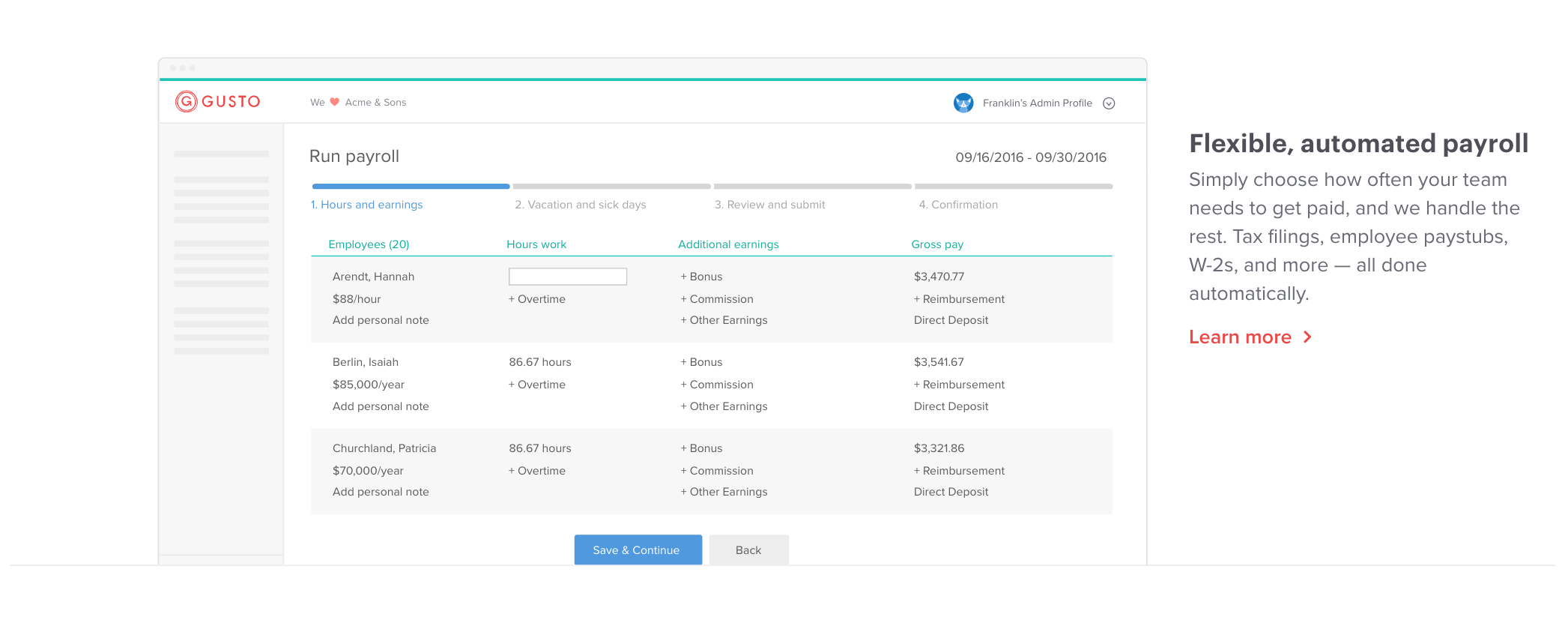

It handles benefits compliance direct deposit employee self-service employee management payment processing and taxes.

Gusto employee tax calculator. With Social Security at 124 and Medicare at 29 Self-Employment is a major cost of 153 right off the top before theres any income taxes paid. Sign in to Gusto. But and this is a big but note that you can claim a tax credit of up to 54 if you pay your state unemployment tax in full and on time each quarter.

13062019 71073 gross payment 21073 taxes 500 net pay for employee You can avoid going through these four steps by using a payroll software like Gusto. 10052019 That works out to 16060 tax owed 73000 x 22 16060. We have made this update to align with the latest Treasury FAQ published on January 19 2021.

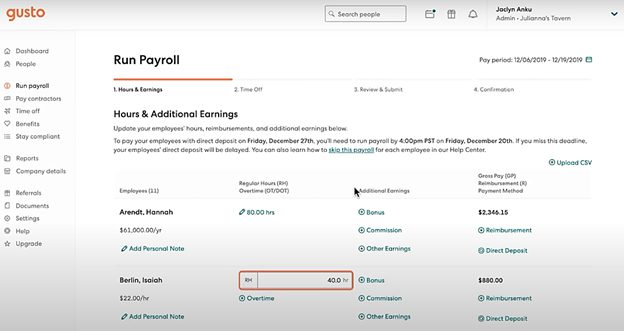

17122020 Calculating Employee Payroll Taxes in 5 Steps. Gusto takes the overtime off calculations year-end forms payroll taxes ACA compliance adopts unique workflow calculations etc. Saving time The main benefit of full payroll automation is saving time.

15032021 The FUTA tax rate is 6 of the first 7000 of taxable income an employee earns annually which means the FUTA tax you pay for each employee is capped at 420 per year. Enter your new withholdings in Gusto. 11092019 The self-employment tax rate for 2021.

If youre new to personal taxes 153 sounds like. For more help calculating your withholdings check out our blog for step-by-step info or read the IRS FAQs. You can find your Paycheck Protection Program Loan report by going to the Reports section in Gusto account and selecting.

Withholding takes place throughout the year so its better to take this step as soon as possible. Gusto has updated our PPP Loan report to include all employee federal taxes imposed or withheld regardless of the lookback period. Gusto provides additional tools to its users as well including a California hourly paycheck calculator a California salary paycheck calculator a payroll tax calculator an employee tax calculator a salary comparison tool a new hire checklist and more.

ZenPayroll Inc dba Gusto Gusto does not warrant promise or guarantee that the information in the Paycheck Calculator is accurate or complete and Gusto expressly disclaims all liability loss or risk incurred by employers or. Once your employees are set up and your business is set up too youre ready to figure out the wages the employee has earned and the amount of taxes that need to be withheldAnd if necessary making deductions for things like health insurance retirement benefits or garnishments as well as adding back expense. Using automation calculators and other administrative and HR modules users can streamline the entire process of paying employees.

Calculate your new withholdings by using the IRS withholding calculator or filling out the W-4 worksheet by hand. This tax calculator shows these values at the top of your results. 20012021 Jan 20 2021 update.

Gusto starts at a base of 45 39month 6 for the first user. Calculate the self-employment tax. As noted the self-employment tax rate is 153 of net earnings.

For each additional employee or subcontractor you add to the system Gusto adds 6 to the total monthly cost. That rate is the sum of a 124 Social Security tax and a 29 Medicare tax on net earnings. The Paycheck Calculator may not account for every tax or fee that applies to you or your employer at any time.

If you earned more than 400 in the year you are required to pay this tax. Gusto is a web-based payroll system for medium-sized organizations. Gusto maintains Twitter Facebook Instagram and LinkedIn.

It doesnt matter how often you run payroll for your company youll still be paying the same monthly fee. Gusto has too many benefits to offer to its users. So if your company is based in Michigan but youre employing a full-time remote employee who lives in New York you as the employer need to register with the relevant tax authorities and deposit taxes in.

All you have to do is enter the bonus amount you want your employee to have after taxes and Gusto will calculate how much you need to pay in seconds. More than 100000 small businesses and their teams trust Gusto. Employees cost a lot more than their salary.

18082020 This is a tremendous service since calculating and tracking payroll taxes is a Herculean task one which can easily contain errors. This is a combination of the Social Security and Medicare taxes that would normally be taken out of your paycheck if you were working as an employee. Our employee cost calculator shows you how much they cost after taxes benefits.

Other factors are added up. 14052021 Use your results from the Tax Withholding Estimator to help you complete a new Form W-4 Employees Withholding Certificate and submit the completed Form W-4 to your employer as soon as possible.

Gusto Enables Employees To Choose Their Own Payday Business Wire

Gusto Vs Paychex 2021 Which Should You Choose The Digital Merchant

Gusto Review 2021 Pricing Features Shortcomings

The 5 Best Hr Software For Small Businesses In 2021

Komentar

Posting Komentar