Gusto Tax Calculator

ZenPayroll Inc dba Gusto Gusto does not warrant promise or guarantee that the information in the Paycheck Calculator is accurate or complete and Gusto expressly disclaims all liability loss or risk incurred by employers or employees as a direct or indirect consequence of. Income tax calculator for tax resident individuals.

![]()

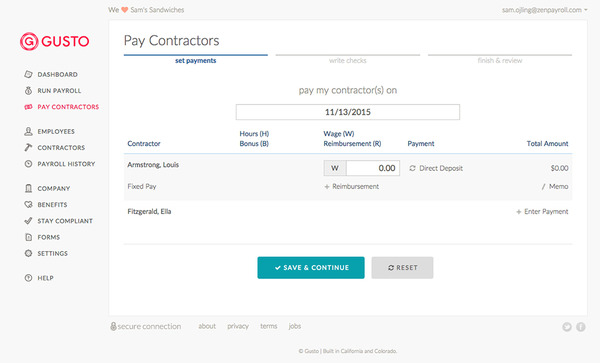

Zenefits Vs Gusto Which Hr Software Is The Winner For 2021

Well do the math for youall you need to do is enter the applicable information on salary federal and state W-4s deductions and benefits.

Gusto tax calculator. The Paycheck Calculator may not account for every tax or fee that applies to you or your employer at any time. Credit claims from 2020. How to calculate the net salary.

ZenPayroll Inc dba Gusto Gusto does not warrant promise or guarantee that the information in the Paycheck Calculator is accurate or complete and Gusto expressly disclaims all liability loss or risk incurred by employers or employees as a direct or indirect consequence of. This is only effective for wages paid March through December 2020. Calculate your new withholdings by using the IRS withholding calculator or filling out the W-4 worksheet by hand.

Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in California. Youre the one who does everything at your company. Once your accountant has set you up to claim the Federal RD Tax Credit you have the option to claim the credit against your employer Social Security taxes in real time.

YA 2021 XLS 170KB New. Sign in to Gusto. ZenPayroll Inc dba Gusto Gusto does not warrant promise or guarantee that the information in the Paycheck Calculator is accurate or complete and Gusto expressly disclaims all liability loss or risk incurred by employers or employees as a direct or indirect consequence of.

Where you live - The municipal tax differs between the municipalities. For personal tax advice consult a CPA or licensed tax advisor. Gusto does not support flexible variable courtesy withholdingfor now there are safeguards in place to make sure that the required payroll taxes both unemployment taxes and income withholding taxes are calculated and withheld based on the applicable address es on file for employees during the work period you pay them for.

Filings marked with an asterisk are coupons or payment vouchers or other forms that are filed electronically and will not appear. Head to the Documents section of your account to view the forms that are available to you in Gusto. Gustos four payroll plans include automatic payroll tax filing workers compensation administration and easy employee self-serviceall for as low as 25 a month.

If you are a member of the Swedish Church - The church fee varies between 1-15 of your salary. In order to calculate the salary after tax we need to know a few things. If you enable real time Gusto will not withholddebit the employer portion of Social Security tax on employees payroll.

YA 2020 XLS 122KB YA 2019 XLSX 42KB YA 2018 XLS 114KB YA 2017 XLS 114KB Compute income tax liability for tax resident individuals locals and foreigners who are in Singapore for 183 days or more 2. Well calculate the amounts you may owe based on your payroll history and allow you to select what youd like us to pay on your behalf. Your gross salary - Its the salary you have before tax.

Federal and state taxes filed by Gusto. If adjustments are made to your account that affect the amount of taxes owed you may be liable to pay more to the federal and state agencies. Gusto even has an automatic payroll service called Gusto AutoPilot saving many business owners time and unnecessary stress.

Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Texas. Click the Get Started tab. As each payroll is processed Gusto debits the appropriate payroll taxes that apply to your company.

The Paycheck Calculator may not account for every tax or fee that applies to you or your employer at any time. If your company has 100 or fewer. Running the payroll hiring new employees making sure everything is compliant and oh yeah building your business.

Well do the math for youall you need to do is enter the applicable information on salary federal and state W-4s deductions and benefits. Free payroll and HR resources. The Paycheck Calculator may not account for every tax or fee that applies to you or your employer at any time.

Its easily one of the best payroll services for small-business owners of all types. Its fast and free to try and covers over 100 destinations worldwide. If you are switching over to Gusto mid-year you may have some outstanding tax liabilities you would like us to pay.

For more help calculating your withholdings check out our blog for step-by-step info or read the IRS FAQs. We then file and pay all of your quarterly and annual taxes. 2020-12-16 Gusto Payroll Review 2021.

The company takes care of payroll calculations and tax filing for you. Gusto is here to help. Check out the full list of forms that Gusto files on your behalf below.

Enter your new withholdings in Gusto. Employers can claim the Employee Retention Credit ERCa refundable tax credit for 50 of up to 10000 in wages per employee per yearThe credit is available for eligible employers whose businesses have been financially impacted by COVID-19. 2021-02-19 Gusto is a cloud-based payroll solution that seamlessly combines benefits administration 401ks HR and onboarding.

Calculate import duty and taxes in the web-based calculator.

The Best Payroll Service For Sole Proprietors Or S Corp

7shifts Gusto Integrated Partner

Become A Gusto Partner And Grow Your Accounting Firm

Payroll Tax Vs Income Tax What S The Difference The Blueprint

Best Payroll Software For Your Business 2021 Edition

Komentar

Posting Komentar