Gusto 401k Contribution

Here are the 2020 contribution limits for 401k plans. 6500 in catch-up contributions 19500 26000.

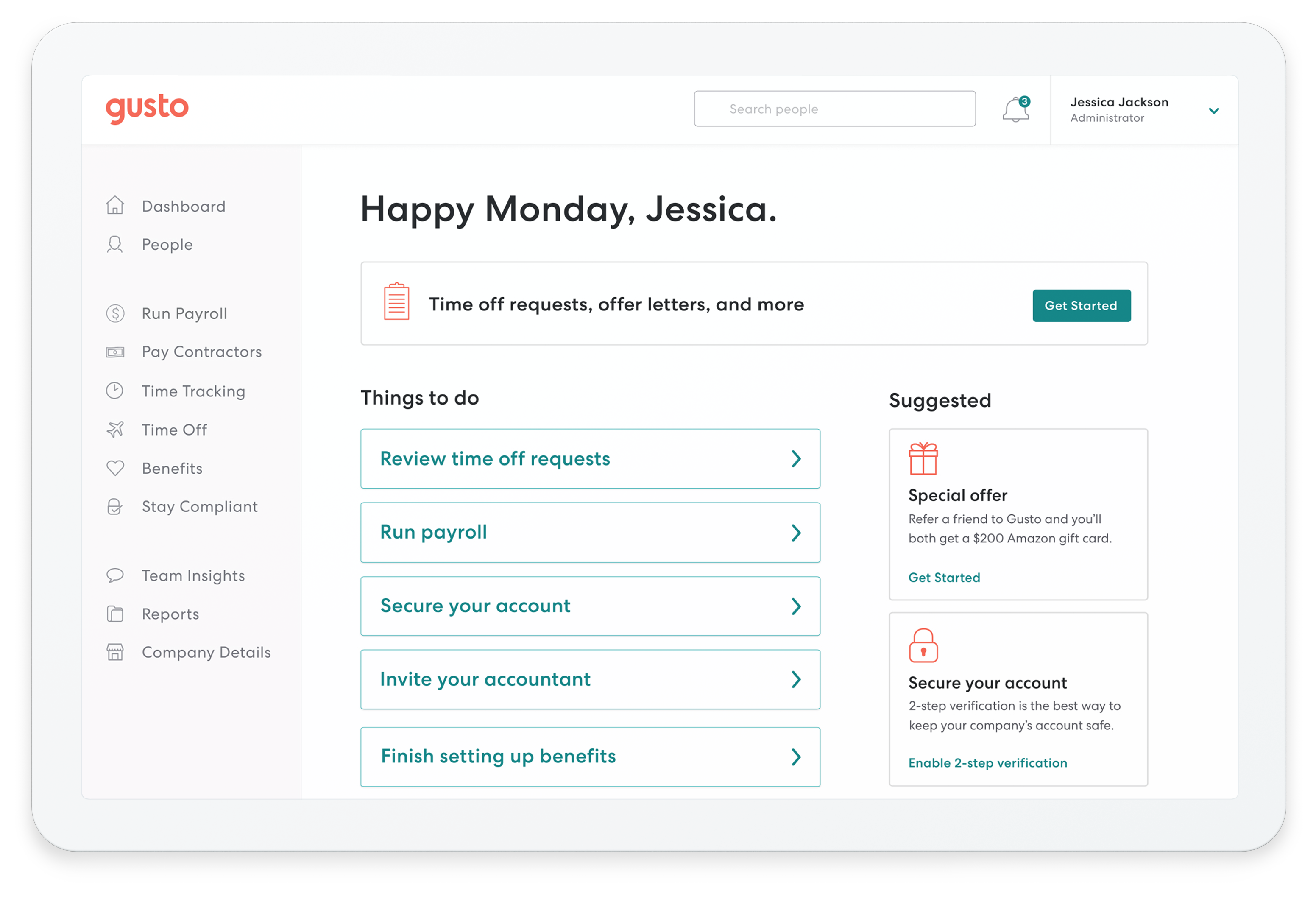

Gusto Adds Hr Features To Its Payroll And Benefits Platform After Hitting 40 000 Users Venturebeat

My company contributes a flat 3 of salary for each of our employees which is a nice benefit for many folks who might not have the means to contribute to a matching plan.

Gusto 401k contribution. Workers age 50 and older can contribute an additional 6500 in 2021. 16072013 Up until this month Ive been contributing steadily to my 401k at work over the last 9 12 years. In other words Roth contributions will not be reflected anywhere on Form 1120S.

19122016 Your teams 401k contribution. The average investment expense of plan assets for 401k plans with 25 participants and 250000 in assets is 168 of assets according to the 20th Edition of the 401k Averages Book with data updated through September 30 2019 and is inclusive of investment management fees fund expense ratios 12b-1 fees sub-transfer agent fees contract charges wrap and advisor. Age 50 or older.

It also would not reduce the amount on line 7 for officers or line 8 for other employees. 28012020 Gusto offers four plans. Save even more with tax credits.

If youre starting a new 401 k your small business may be eligible to receive up to 16500 in tax credits over the plans first three years to help offset initial plan costs. 05022019 When we decided to offer a simple IRA benefit ADP had an option to manage that. Glassdoor is your resource for information about the 401K Plan benefits at Gusto.

The underlying plan can be a profit-sharing stock bonus pre-ERISA money purchase pension or a rural cooperative plan. Well we stayed with them because we really didnt have any other options at the time around 2012. But whatever the reason if you go with Gusto you shouldnt ever have to manually enter payroll into your accounting software.

Also called Required Minimum Distributions RMDs they start at. We handle the nitty gritty. As part of a Guideline 401 k.

Employees 50 and older. 07122020 The 401 k contribution limit is 19500 in 2021. 21032020 The only difference with a contribution to the Designated Roth Account in the 401k is that the amount would not be included on Form 1120S line 17 because it is not deductible.

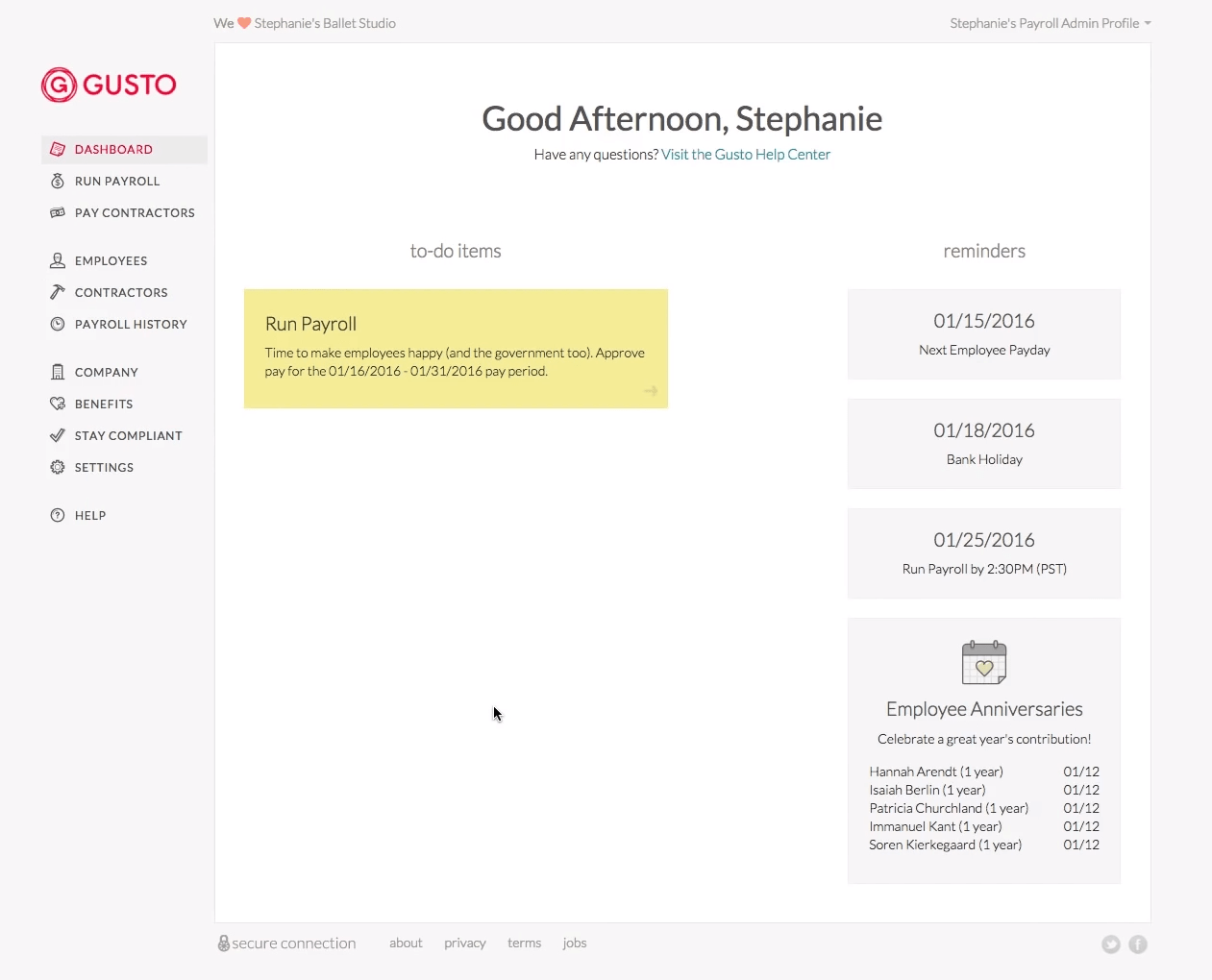

29032021 Gusto offers a one-month free trial that starts after a company runs its first payroll. When youre of retirement age annual withdrawals from a 401k become required. 08102019 Also many 401k providers can interface with payroll systems to make contributions and record keeping easy and seamless.

The maximum contribution an employee under 50 can make in 2019 is 19000. Contributions are deducted from an employees gross pay and put into a 401k account. You can get a 401k fully integrated with your Gusto account through our partner Guideline.

Your S-corp must issue a corrected W-2 Form W-2C if the original W-2 failed to report employee elective. How much do your employees want to invest in their 401ks. Qualifying for a 401 k.

Profit sharing is a great way to thank your employees while being mindful of your finances. 2021 Gusto iframe stylewidth. The Enhanced Plan eliminates this issue.

1 A matching contribution of 100 of employee contributions up to 3 plus 50 on the next 2 2 match of 100 up to the first 4 or 3 a 3 non-elective contribution to eligible employees. Want to sign your company up with Gusto. 01042020 For 2020 only annual compensation up to 285000 can be used for the calculation of any employer contribution.

Under age 50. Learn about Gusto 401K Plan including a description from the employer and comments and ratings provided anonymously by current and former Gusto employees. 401 k retirement plans 401 k retirement plans have a 40 per month minimum plus an 8 per participant per month charge and a 500 set-up fee.

31052019 Report Inappropriate Content. 05022021 Employee contribution limit. They are fintech much like Gusto Robinhood M1 etc.

Gusto payroll offers affordable integrated benefit options such as a 529 College Savings Plan a 401k contribution health. Basic Core Complete and Concierge. Gusto also offers additional options for employee benefits and insurance.

After about two years we wanted to be more competitive and decided to offer a 401k with a 4 matching contribution. Forgot to report solo 401k employee contributions after w-2 was already filed. You just get a great plan.

23112020 A 401 k plan is a qualified plan that includes a feature allowing an employee to elect to have the employer contribute a portion of the employees wages to an individual account under the plan. Employees younger than 50. If the employee is over 50 they may make an additional catch up contribution of 6000.

The company assesses a monthly subscription fee as well as a per-employee fee and all of.

Gusto Payroll Software 2021 Reviews Pricing Demos

Introducing Financial And Health Benefits For All Businesses Gusto

Gusto Review 2021 Businessnewsdaily Com

Gusto Payroll Pricing Plans Fees Explained

5 Steps Guide To Enrolling Health Benefits In Gusto Financesonline Com

Komentar

Posting Komentar