Gusto 401k Guideline

It does this with a SaaS-based offering that includes a small 500 fee. Use this link to make sure we have your most up to date resume on file.

Gusto Brand Small Business Resources Words Matter Looking For People

We utilize Guideline as our 401k provider.

Gusto 401k guideline. If you are a Gusto customer you can now provide your employees with a 401k plan for only 8 a participant per month. We utilize Guideline as our 401 k provider. To roll over a previous retirement account to G.

Bait and switch is built into this companys DNA. You just get a great plan. Share this link with anyone who you think might be a good fit to work for TA3.

Back The easy affordable 401k for Paychex customers. 04062021 Guideline is the first full service 401 k without added management fees. We know that being straightforward saves time and money.

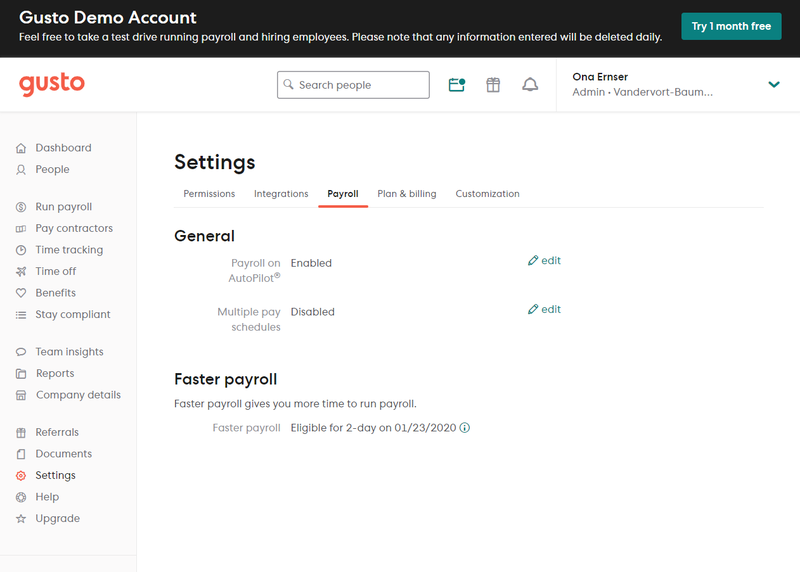

This saves time and ensures accuracy. 19012020 User Review of Guideline. Contributions automatically sync with payroll and both employers and employees have access to 401k dashboards within Gusto.

As a small business It has been a very efficient and easy tool for our. If you would like to learn more about this offering including costs and plan details please check out our website. We added this benefit in 2019 and made the decision primarily because Guideline gave us an easy and efficient vehicle to offer the benefit due to online admin not having to deal with a broker and integration with Gusto our payroll system.

Gusto Payroll RocketKlock Timekeeping Guideline 401K Service Express Resume. And if youre an accountant we hope that this webinar provided valuable. Small businesses using ADP for payroll can also use Guideline.

Click here for an outline to our key services and pricing. If you were automatically enrolled in your comp. 12122018 HR benefits company and payroll provider Gusto exclusively offers Guideline as its 401k provider to its customers as does Square.

Weve partnered together to offer a fully integrated 401k system. Gusto partners with Guideline to offer a fully integrated 401k solution. Increase or decrease your contribution rate at.

08082017 Founded in 2015 Guideline wants to make it easier for small and medium-sized businesses to offer 401 k retirement accounts. 1 Employers pay a flat fee employees pay a low fund expense and everyone understands what they are paying for. This time adding an obnoxious monthly flat fee as well as AUM fees that they were sooooo against previously.

Contributions automatically sync with payroll and both employers and employees have access to 401k dashboards within Gusto. If youre starting a new 401 k your small business may be eligible to receive up to 16500 in tax credits over the plans first three years to help offset initial plan costs. If you would like to learn more about this offering including costs and plan details please check out our website.

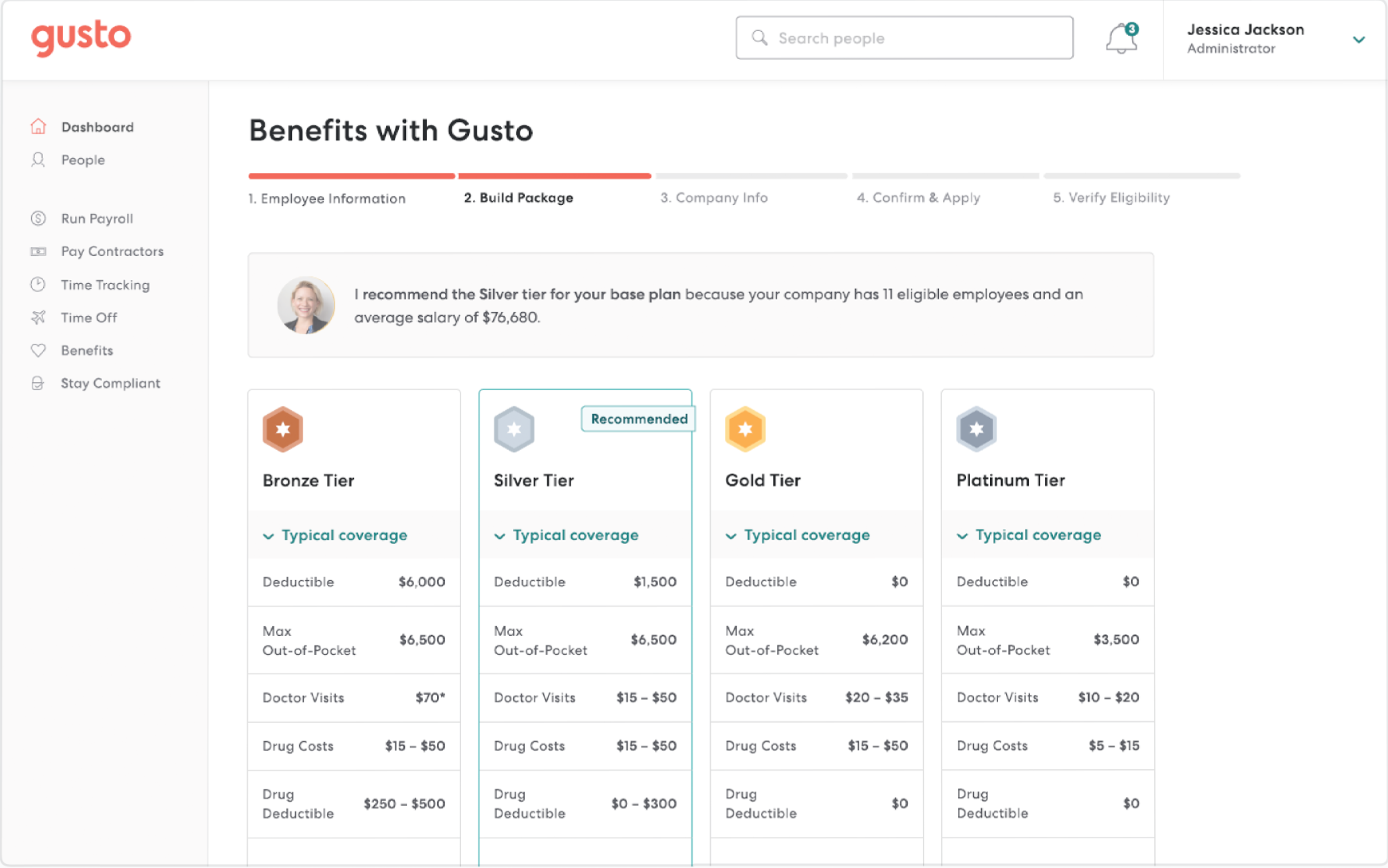

As a result my companys 401k fees are increasing by 825 per year. You set up your plan with the partnership with Guideline a 401k administrator and custodian who takes care of all of the heavy lifting with the plan. Gusto offers integration of Guideline 401k plans workers compensation policies and other benefits.

We added this benefit in 2019 and made the decision primarily because Guideline gave us an easy and efficient vehicle to offer the benefit due to online admin not having to deal with a broker and integration with Gusto our payroll system. The payroll system also integrates with QuickBooks Online so any time payroll is run Gusto transmits the journal entries automatically to the bookkeeping system. 39month 8employee seems pretty good and you get Vanguard funds as well.

Guideline bait and switch Guideline recently increased their fees. How do I rollover my retirement account to Guideline. Guideline 401k syncs with popular payroll providers take care of plan administration and offer low-cost mutual funds.

How to distribute or rollover your 401k funds from Guideline. 05022019 Guideline uses Vanguard home to some of the best performing funds and lowest fees to manage the 401k plans. 08102019 Has anyone used Guideline 401k service instead of setting up your own.

They are partnered with a lot of payroll companies like Gusto and can automatically deduct and take care of all of that. Seems like annual fees would be less than setting up your own. Guideline also plays.

12052021 If youre ready to start a 401k for your small business Gusto and Guideline can help. Save even more with tax credits. Gusto partners with Guideline to offer a fully integrated 401k solution.

The 401k plan is integrated directly with Gusto. Our product makes managing your 401 k easy - for you and your employees. We handle the nitty gritty.

Guideline brought all their fees in house and they charge probably half of what wed been paying to ADP which was several thousand dollars every year. I was auto-enrolled can I get my money back. Check your balance contribution rate recent activity and important notifications - all in one place.

12122020 Today we are reviewing Guideline a relatively new player in the small business 401k market thats attacking the problem of expensive difficult to administer retirement plans with unique technology and clever designFounded in 2015 the company is sometimes referred to as the Gusto 401k because of its robust payroll integrationBut fear not. 13092016 Now you can easily start a cost effective 401k plan with Gusto. If youd like to request a distribution from yo.

So in early 2018 we switched to Guideline.

Gusto Software 2021 Reviews Pricing Demo

Gusto Payroll Pricing Plans Fees Explained

Gusto Pricing Features Reviews Alternatives Getapp

Gusto Payroll Review 2021 Features Pricing More The Blueprint

Komentar

Posting Komentar