Gusto 1099 Employee

While you understand when and how to file a 1099-NECs and a 1099-MISCs for your contractors its critical you understand what the 1099-K is and how it could impact your business. It even goes further into managing different benefits that you might offer your employees time off vacation holidays etc.

Gusto Payroll Review Erin Armstrong Payroll Financial Decisions Business Tax Deductions

23092017 Yes in addition to your full- and part- time employees you can also pay contractors through Gusto.

Gusto 1099 employee. Gusto is also a powerful HR and benefits management solution with employee benefits administration. 07082020 1099 VS W2 Employees. Automatic payment of taxes and filing of your Federal State.

No need to outsource. Want to sign your company up with Gusto. You can track your pre-existing benefit plans in Gusto.

Gusto makes it easy to pay your contractors today and W-2 employees tomorrow. Gustos pricing ranges from 3900 base price 600 per employee per month to 14900 base price 1200 per employee per month. Gusto will process their payments and generate 1099 forms for these contractors at year end.

Gusto helps you take care of your team like a pro in record time. 1099 workers are contractors and W2 personnel are employees. Pay employees via direct deposit or paper check.

Split payments to multiple accounts. You can view all of the necessary reports and statements within the respective payroll platforms. Easily add W-2 employees and upgrade to full-service payroll benefits and more.

Krystal Barghelame Former Integrated Marketer Gusto. While you may have heard the term 1099 employee its a misnomer. Includes W-2 1099 940 8974 941 state and local forms.

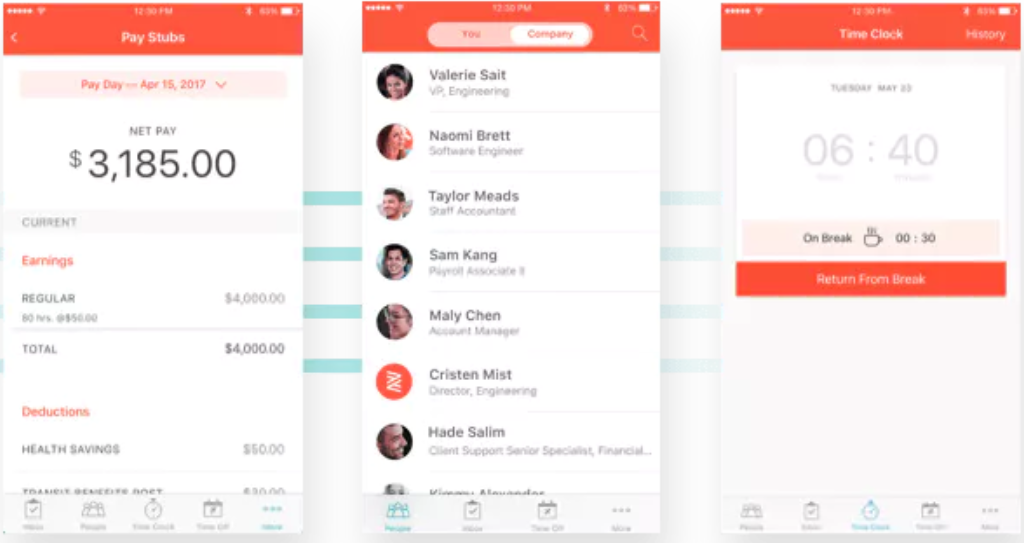

Employees get their own login so they can onboard themselves access paystubs W-2s 1099s and more This application is a Top Pick this may mean that the third party application is a popular application with FreshBooks Users. Does Gusto have the ability to track benefits. Gusto full-service payroll providers meaning they will file all applicable W2s and 1099s at year end.

W2 employees are salaried workers with benefits insurance and vacation days. And if you work with 1099 contractors instead of W-2 employees Gustos Contractor plan has a 0 base costyoull just pay 6 per. Gusto automatically calculates deposits and files your payroll taxes.

Learn more about the 1099-K. 1099 workers on the other hand are freelancers. Gusto may terminate the Promotion Terms andor the Promotion or modify the Promotion Terms andor the Promotion for any reason.

08032021 Easy-to-use cloud-based HR software backed by expert support. Your employees set up themselves all online and get lifetime accounts. 15052018 Once you have entered at least one W-2 employee to your Gusto account you can then add 1099 independent contractors.

Includes W-2 1099 940 8974 941 state and local forms. Gusto offers full-service payroll across all 50 states unlimited payroll runs and direct deposit. Automated filings of 1099s and state new hire reports to help with compliance.

A company with 15 employees would be paying a monthly rate of 219. 16122020 Now Gustos Core plan starts at 19 a month plus 6 per payee per month for the first six months. 10032020 Gusto is a platform that allows businesses to manage new employee onboarding payroll pay 1099 contractors owner withdrawals and much more.

Further Gusto automates W-2 and 1099 filings on your behalf with additional help to resolve IRS notices and amendments at no extra charge. We also automatically file your required new hire reporting for you and generate file and deliver 1099-MISC forms at the end of the year at no extra cost. Gusto also offers various optional add-ons that are priced individually.

Employees are full-time staff members who make up your team on a day to day basis. This includes Gusto Payroll pricing. Just 6 per contractor per month includes direct deposit and unlimited payments.

All earnings are reported in Box 1 of the 1099-NEC as non-employee compensation. Heres how to access your 1099-NEC. Payroll management and tax computation solution designed for businesses of all sizes to help them manage and reduce tax.

17092019 Gusto does not allow syncing of payments for 1099 contractors only W2 employees are included in payroll Step 8 A pop-up notification will appear asking you to confirm your selection in the previous screen. A 1099 employee technically doesnt exist because employees are classified differently than independent contractors and its contractors who use the 1099 form. Administer pre-tax benefits and deductions for healthcare 401k.

Heres the most important thing to remember. Dont have an employee account. Gusto files 1099-NEC forms to the IRS and to the required states for all domestic contractors who have been paid through Gusto within the calendar year.

11122020 Heres Your Paperwork Checklist. With an email address for the contractor you have the option of allowing the contractor to enter their information themselves. 31032021 Gustos Complete plan is 39 a month with an additional 12 for each employee paid through the software.

How To Onboard And Pay Independent Contractors Gusto Youtube

What Is Form 1099 Nec How Do I File Form 1099 Nec Gusto In 2021 Tax Forms Federal Income Tax Tax Season

Everything You Need To Know To Apply For An Sba Express Loan Profit And Loss Statement How To Apply Expressions

How To Successfully Hire Your First Independent Contractor Hiring Independent Contractor Contractors

Gusto Vs Zenefits Which Is Best

Komentar

Posting Komentar