Gusto Quarterly Taxes

In 2017 certain small businesses can now qualify for a research. To meet the safe harbor and avoid an underpayment penalty she has to pay at least 9000 90 10000 of quarterly taxes by April 15.

Quarterly Taxes Everything Small Business Owners Need To Know Gusto

Here are some things you can ask depending on when you join with us.

Gusto quarterly taxes. Partner with Gusto to help your clients claim this credit on their quarterly payroll filings. If your total tax liability is more than your deposits youll enter that amount here. 2nd Quarterly Estimated Tax Payment - June 15 2021.

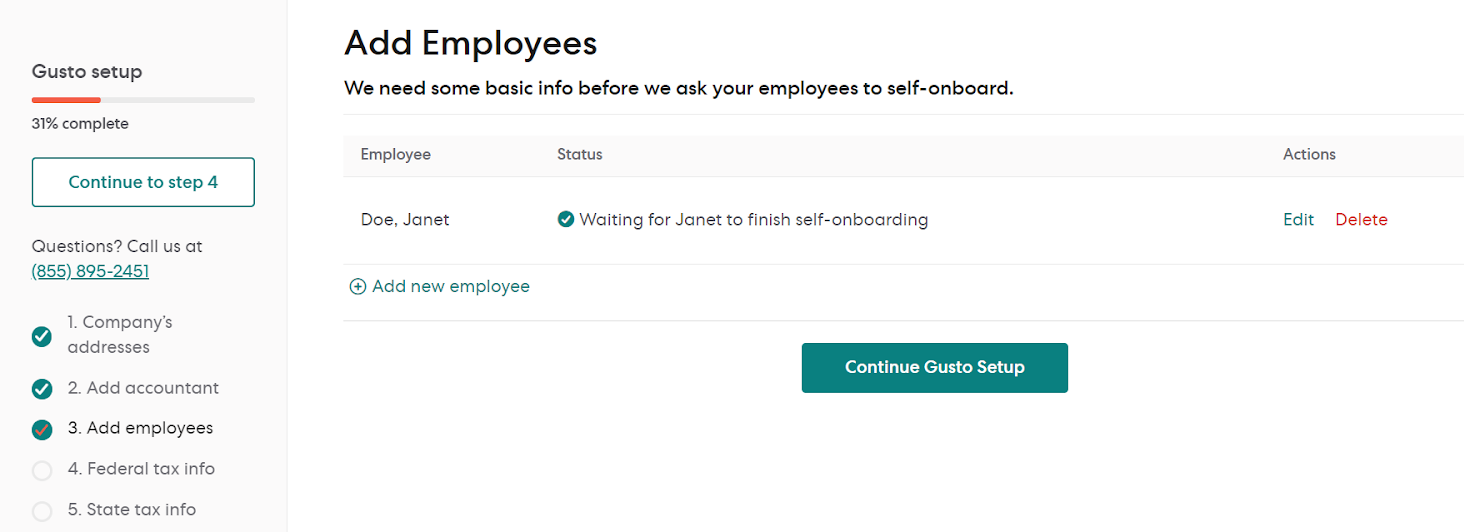

Some forms coupons or payment vouchers that are filed electronically may not appear in your Documents tab. Lets find the right plan for you and your team. If you are joining Gusto for your first payroll in the quarter say.

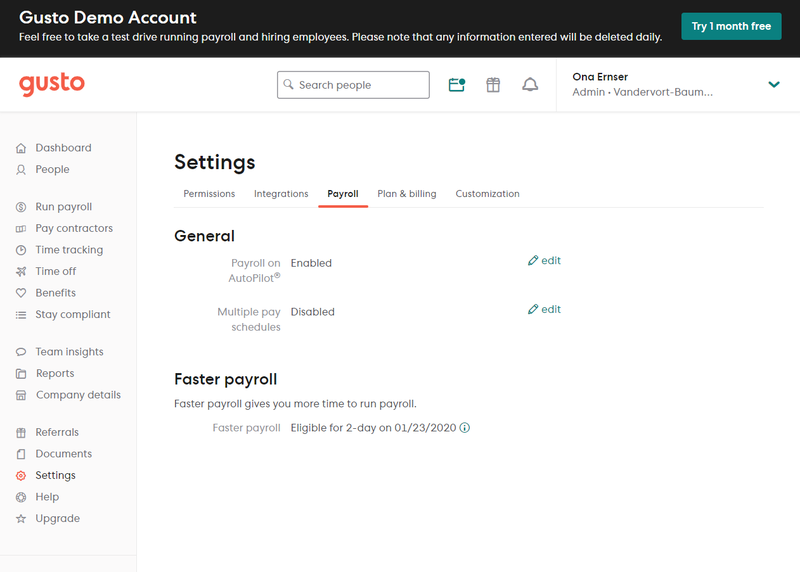

If you indicate that you have a W2 job the calculator assumes standard withholding allowances and subtracts your expected end-of-year refund from the end-of-year tax liability. Gusto for new business Set your new business up with modern payroll benefits and HR Switching to Gusto Transfer your payroll benefits and HR from another provider For accountants A. Click the Company tab.

When are quarterly estimated taxes due for 2021. This is one of the biggest reasons I recommend Gusto to my clients. To calculate this subtract line 13 from line 12.

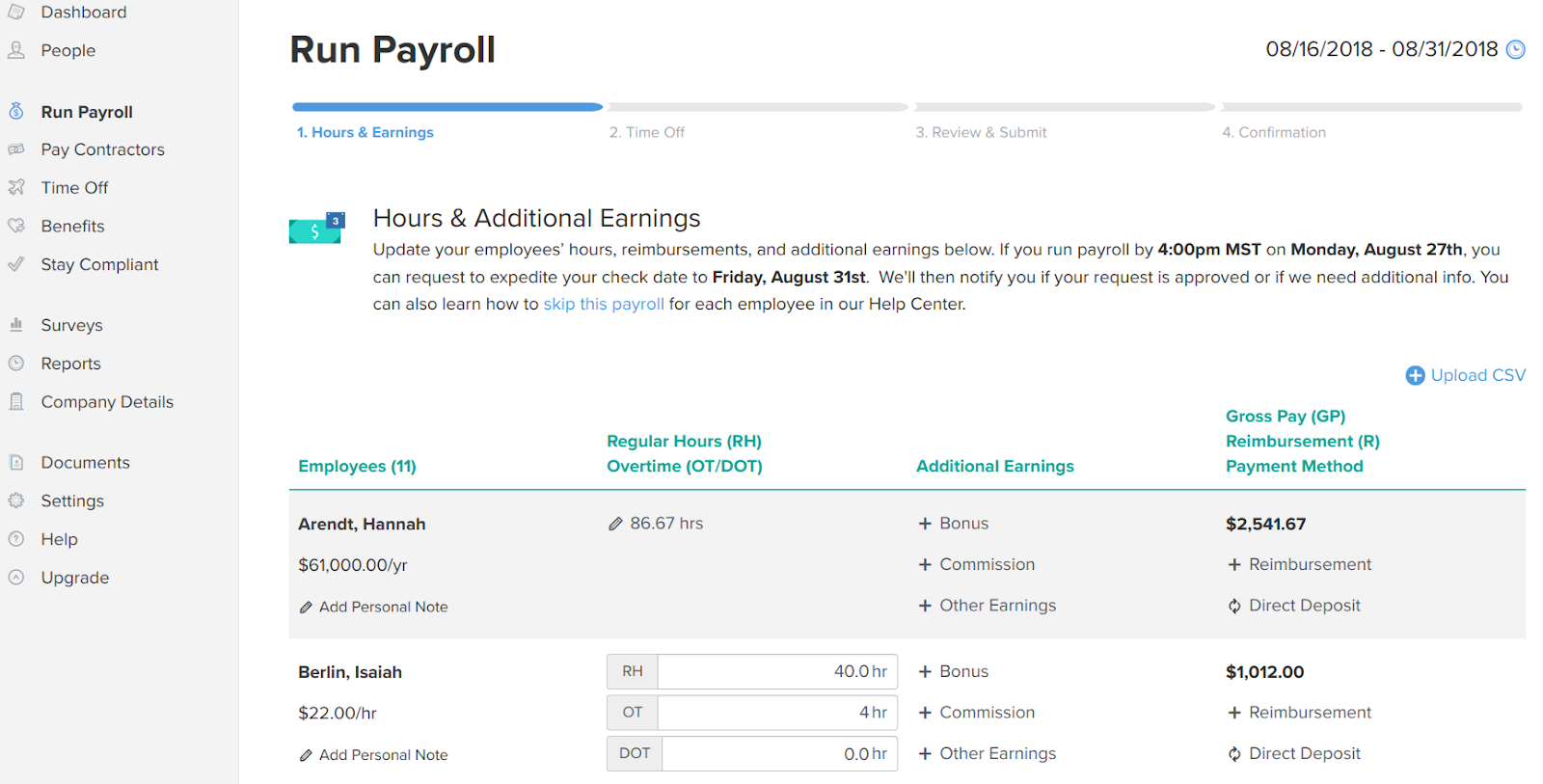

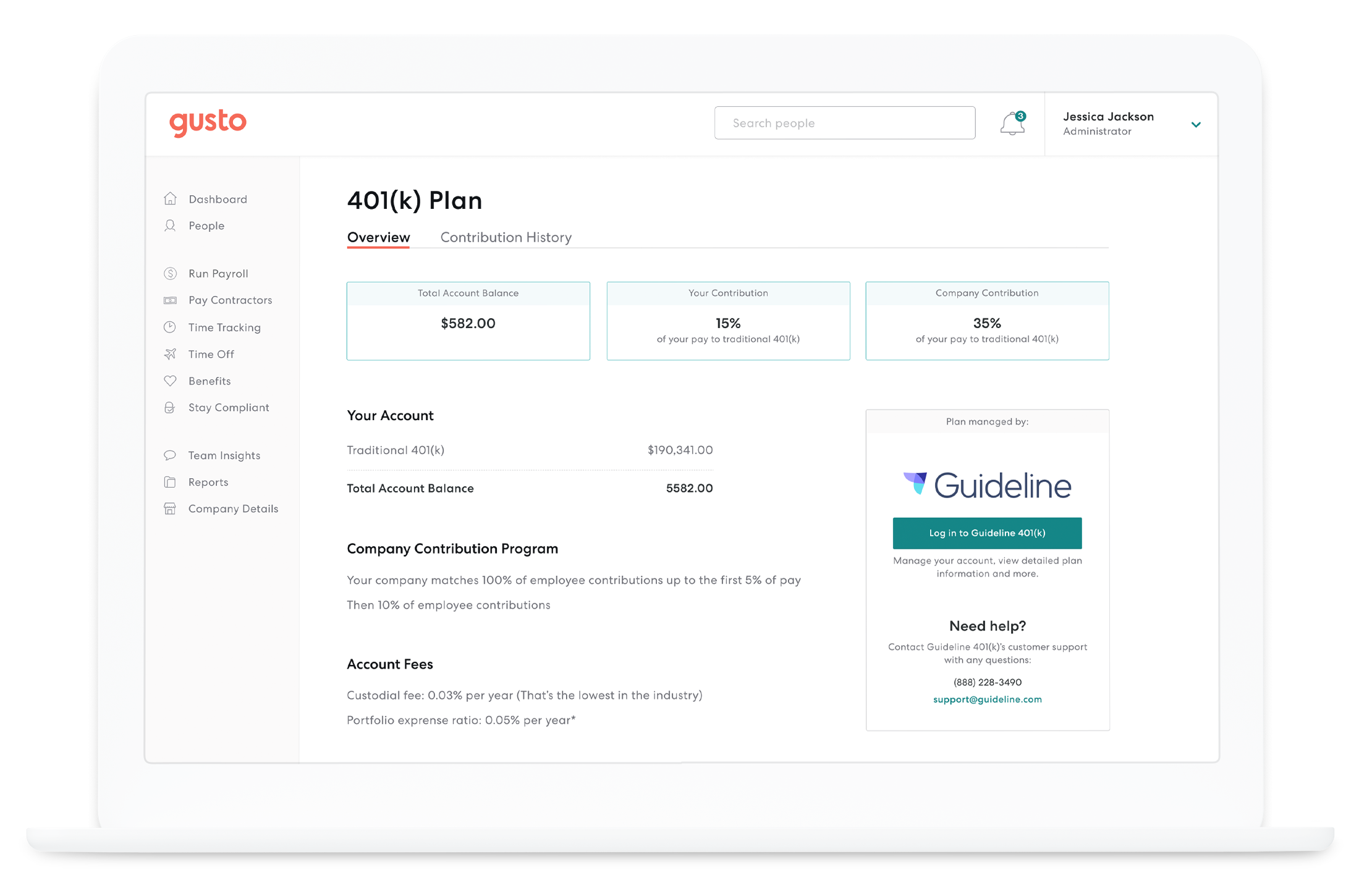

Businesses love Gusto for its easy setup automated tax filings and integrated benefits. Employers Quarterly Federal Tax Return and Report of Tax Liability for Semiweekly Schedule Depositors Form 941 and Schedule B Qualified Small Business Payroll Tax Credit for Increasing Research Activities Form 8974 Employer copies of Wage and Tax Statement and Corrected Wage and Tax Statement Form W-3 W-2 and Form W-2C. This calculator estimates your federal and state-level income tax and then divides by four.

We then file and pay all of your quarterly and annual taxes. The Federal RD tax. 2020-01-30 But this doesnt mean you can wait until April 15 to pay all the tax you owe for the year.

They make quarterly taxes onboarding. Ask them about every tax liability that you see on Gustos Pay Previous Tax Liabilities screen. That is once every quarter.

To view these forms. The IRS calls these quarterly tax payments estimated taxes. If youre a Gusto Partner you can download quarterly tax packages and end of year W-2 and 1099 forms for all your clients.

Development RD tax credit of up to 250000 per fiscal year against their employer Social Security tax liability. 4th Quarterly Estimated Tax Payment - January 15 2022. If adjustments are made to your account that affect the amount of taxes owed you.

Heres what you need to know about estimated taxes. If any of your clients have amended returns youll need to reach out to a company admin to retrieve them. Enter your total deposits for the quarter as well as any overpayments you made in previous quarters.

Gusto is a full-service payroll provider at a self-service price. Click the form for the quarter or year you want to view. 2021-04-27 As a result she made 60000 in capital gains in 2021 Q1.

Gusto is the best payroll for small businesses. These will be available for you mid-month after the quarter ends. 2019-10-24 Subtract line 11 from line 10.

Please file and pay all quarterly tax filings for the previous quarter. For a full list of the forms filed by Gusto. To avoid an Underpayment of Estimated Tax penalty be sure to make your payment on time.

3rd Quarterly Estimated Tax Payment - September 15 2021. Gustos next-cheapest plan Core starts at 39 a month plus 6 per payee and the cost goes up from there. Payroll Tax Return Filing.

2020-12-16 Gusto payroll costs 25 a month if you choose the Basic plan and have just one employee. 2017-06-28 However Gustos software is easy for anyone including a new business owner. As each payroll is processed Gusto debits the appropriate payroll taxes that apply to your company.

Discover today why Gusto is the HR platform for you. Will you be refunding me any unpaid taxes. 1st Quarterly Estimated Tax Payment - April 15 2021.

To earn up to 4500 when you add clients to Gusto terms apply. WORKS WITH GUSTO My favorite thing about Gusto is the compliance aspect. It uses the latest federal and state level tax brackets and standard deductions.

The difference is your quarterly tax liability. If youre paying contractors only you can skip the monthly base feeGustos contractor plan costs 6 per contractor paid per month. Itll only take a minute.

Get started Good news in 2021 Gusto offers more benefits than ever before. Gusto tax-advantaged accounts are currently available in all the states where we support health insurance which currently includes Arizona Arkansas California Colorado Connecticut Delaware Florida Georgia Idaho Illinois Indiana Iowa Kansas Kentucky Maine Maryland Massachusetts Michigan Minnesota Missouri Nevada New Hampshire New Jersey New Mexico New York. If youre self-employed you ordinarily have to make tax payments to the IRS four times during the year.

Click the Documents tab.

What Is Form 941 And How Do I File It Ask Gusto

Gusto Vs Adp Pricing Features More 2021 The Blueprint

How To Set Up And Run Payroll With Gusto

How To Set Up And Run Payroll With Gusto

Gusto Pricing Features Reviews Alternatives Getapp

Komentar

Posting Komentar