Gusto Salary Calculator California

To run a bonus payroll follow these steps. Next to the employee click Enter Payment.

How To Calculate Process Retroactive Pay

To calculate how much he should be paid.

Gusto salary calculator california. Select your job title and find out how much you could make at Gusto. Our employee cost calculator shows you how much they cost after taxes benefits. Use this free salary comparison calculator to find the average salary for your job in your state.

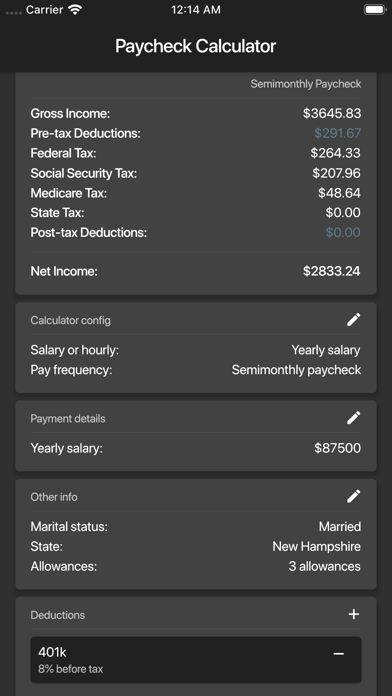

Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in California. Social Security aka Old-Age Survivors and Disability Insurance or OASDI has a wage base of 127200 as of 2017 an amount that increases regularly to keep pace with inflation. Simply enter their federal and state W-4 information as well as their pay rate deductions and benefits and well crunch the numbers for you.

Click Advanced Settings if you are adjusting the default payroll settings for this bonus payroll. Get started Good news in 2021 Gusto offers more benefits than ever before. The payroll tax modeling calculators include federal state and local taxes and benefits and other deductions.

By making the most complicated business tasks simple and personal Gusto is reimagining payroll benefits and HR for modern companies. Simply enter their federal and state W-4 information as well as their pay rate deductions and benefits and well crunch the numbers for you. 572 Gusto employees have shared their salaries on Glassdoor.

Your employee who earned a 100000 salary was dismissed after 3 days into a pay period. The following calculation will be used for gross wages. 40 regular hours x 20 regular pay rate 800 regular pay.

Get the daily rate. 14062021 572 salaries for 284 job titles Updated Jun 14 2021. 800 regular pay 300 regular OT pay 1100 total gross wages.

Multiply the daily rate by how many days they worked. 15 x RRP for all hours on the 7th day of a week. To earn up to 4500 when you add clients to Gusto terms apply.

Gustos mission is to create a world where work empowers a better life. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees. Get started Good news in 2021 Gusto offers more benefits than ever before.

Monthly Pay Weekly Pay Hourly Wage. Calculates net pay or take home pay for salaried employees which is wages after withholdings and taxes. Are you being paid enough.

Your employee works 40 regular hours a week at 20 per hour. Gusto serves over 100000 companies nationwide and has offices in San Francisco and Denver. Divide the salary by 260 of working business days in a year.

15 x RRP for all hours over 40 in a week. Both you and your employee will be taxed 62 up to 788640 each with the current wage base. She decides to work an additional 10 hours in overtime.

10 regular OT hours x 20 regular pay rate x 15 300 OT pay. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in California. Click the Run Payroll tab.

Refer to FLSA definition. Project Management Salaries 556 salaries for 271 job titles Updated Apr 3 2021 556 Gusto employees have shared their salaries on Glassdoor. Other factors are added up.

Well do the math for youall you need to do is enter the applicable information on salary federal and state W-4s deductions and benefits. To earn up to 4500 when you add clients to Gusto terms apply. Enter the bonus amount.

Well do the math for youall you need to do is enter the applicable information on salary federal and state W-4s deductions and benefits. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees. On the 7th consecutive day worked employees will earn overtime paid at 15x their regular rate of pay for all hours worked on the 7th day.

Calculates take home pay based on up to six different pay rates that you enter. Round this number to the nearest cent. Select the check date.

Employees cost a lot more than their salary. 7th consecutive day. Gusto for new business Set your new business up with modern payroll benefits and HR Switching to Gusto Transfer your payroll benefits and HR from another provider For accountants A rewards program for accountants and bookkeepers Pricing Starting at just 45 per month.

03042021 Gusto Product.

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

10 Best Free Payroll Calculator In India Fy 2021 22 Paycheck Calculator

Paycheck Calculator For Excel Paycheck Salary Calculator Consumer Math

American Companies Can Now Settle Payroll Taxes In Cryptocurrency Via Bitwage Payroll Taxes Payroll Accounting

Net Salary Calculator Templates 13 Free Docs Xlsx Pdf Salary Calculator Salary Calculator

Komentar

Posting Komentar